Maxeon Solar Panels

Not all solar is made equal. Maxeon’s flagship back contact solar panels are the toughest, most reliable solar panel for decades worth of energy.

Maxeon interdigitated back contact (IBC) solar panels create more energy over their lifetime thanks to their industry-leading efficiency and 40-year warranty.

Maxeon solar technology performs better

The patented Maxeon IBC solar cell design comprises more than four decades of research and development innovation, delivering industry-leading efficiency that enables your solar system to produce more energy, for longer.*

Maxeon solar panels look better on your home or business

An elegant all-black aesthetic enables Maxeon IBC solar panels to integrate seamlessly with any roof, maximizing curb appeal.

Maxeon solar panels provide the ultimate in durability

Maxeon IBC solar panels offer greater resilience to real-word challenges like wind, high heat, shade, and hail to make sure your system is producing energy whenever you need it—and that’s a big reason why they’re the only panel that’s accompanied by a comprehensive 40-year warranty.

The Maxeon Advantage

-

Create more energy

High-efficiency cell design maximizes sunlight conversion

Panels capture more sun in low light conditions—creating more energy earlier in the morning, on cloudy days, and later in the evening

Panels maintain their power advantage over time with the industry’s lowest warranted degradation rate*

Highest quality materials (ultra pure silicon and anti-reflective glass) support efficient energy production

-

Outlast the competition

Solid metal cell foundation prevents and contains cracks, and eliminates the risk of hotspots

Reinforced cell connections absorb thermal expansion and contraction to keep energy flowing

Humidity resistant encapsulant and reinforced electrical housing stops rain, harsh salty air or destructive damp heat from corroding metal components

Durable, protective frame resists high winds and salt-mist corrosion near the coast

-

Technology Videos

Cheap solar panels just can’t match the real-world track record of the Maxeon solar panel for customer performance and value over the long haul.

Over the past few years, we’ve seen a steady stream of new manufacturers and unproven technologies entering the market — bringing with them promises of higher efficiency and lower costs. One common denominator, however, is they just can’t match the real-world track record of the Maxeon panel for customer performance and value over the long haul.

Learn more here →

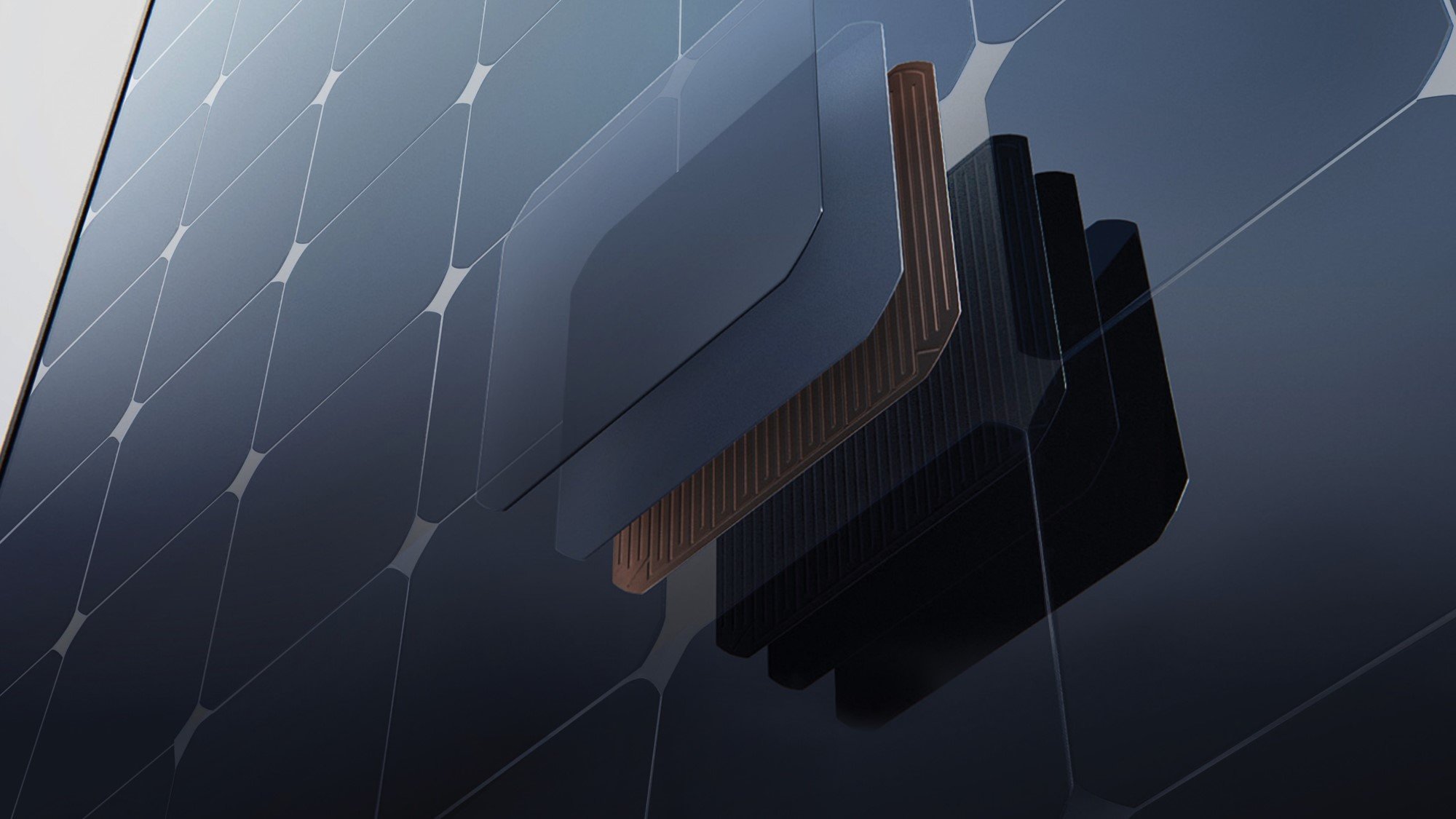

Cracked cells in standard panels can occur from transport, installation, environmental stresses, and even poor manufacturing quality. Maxeon cells are reinforced by a thick plated layer of metal for added structural strength. If a crack forms, the metal backing holds the cell in place while maintaining full electrical conductivity.

Cracked cells in standard panels can occur from transport, installation, environmental stresses, and even poor manufacturing quality. Maxeon cells are reinforced by a thick plated layer of metal for added structural strength. If a crack forms, the metal backing holds the cell in place while maintaining full electrical conductivity.

It takes just a little bit of shade to impact the power output of a solar panel. Standard solar panels typically activate bypass diodes to counter the obstruction—shutting down an entire section of the panel to mitigate heat build-up—sacrificing energy generation in the process. Maxeon panels offer greater resilience to shade, powering through small obstructions with only a slight reduction in power output.

It takes just a little bit of shade to impact the power output of a solar panel. Standard solar panels typically activate bypass diodes to counter the obstruction—shutting down an entire section of the panel to mitigate heat build-up—sacrificing energy generation in the process. Maxeon panels offer greater resilience to shade, powering through small obstructions with only a slight reduction in power output.

The unique design of Maxeon panels not only features an engineered encapsulant that is highly resistive to moisture, but thick, plated copper which is much more robust and able to better withstand corrosion.

A solar panel’s encapsulant plays a critical role in protecting against humidity and moisture-induced corrosion. In humid conditions, moisture can penetrate through the layers of standard solar panels, corroding the panel’s thin metallic electrical connections. The unique design of Maxeon panels not only features an engineered encapsulant that is highly resistive to moisture, but thick, plated copper which is much more robust and able to better withstand corrosion.

Maxeon solar panels feature thick, plated copper contacts for long-term stability. Each tab offers redundant connections with built in strain relief, to ensure a consistent flow of energy while having the flexibility to expand and contract with temperature changes.

As the ambient temperature heats and cools on a daily basis, the metallic ribbons used in standard solar cell connections expand and contract with the temperature change. This repetitive contraction and expansion causes the metal connections to degrade and break over time. Maxeon panels on the other hand feature thick, plated copper contacts for long-term stability. Each tab offers redundant connections with built in strain relief, to ensure a consistent flow of energy while having the flexibility to expand and contract with temperature changes.

Shaded Maxeon cells demonstrate lower heat generation, that is more evenly spread across the entire cell. As such, the diodes in Maxeon panels activate less frequently, increasing both energy production and useful life of the panel.

When an area of a standard solar panel, due to shading for example, can no longer produce enough current to match its neighboring cells, the cells begin consuming power from the surrounding cells and converting it to heat. While bypass diodes are used to prevent overheating, persistent activation can cause the diodes to fail which makes the panel susceptible to hotspot formation. Shaded Maxeon cells demonstrate lower heat generation, that is more evenly spread across the entire cell. As such, the diodes in Maxeon panels activate less frequently, increasing both energy production and useful life of the panel.

The most sustainable

choice in solar

Maxeon Solar Technologies has been recognized by Corporate Knights as one of the world’s most sustainable corporations through its Global 100 index*

The company is NASDAQ listed with adherence to strict governing principles that are intended to guide company stability and endurance

Panels are manufactured with a stringent conflict minerals policy to support responsible sourcing of raw materials, as well as zero tolerance for violations of human and labor rights across our supply chain

Responsible materials sourcing ensures that at the end of their 40+ year life, panels can be recycled and given a new life outside of a landfill

Maxeon IBC panels were the first panel Cradle to Cradle Certified™ Silver, demonstrating high standards in material health, water stewardship and social fairness*

Maxeon IBC panels were also the first solar panel to publicly disclose panel materials through the use of the International Living Future Institute’s Declare Label program*

The longest, most comprehensive warranty coverage in solar

Others make promises their warranty doesn’t support. We’re different. *

Our industry-best 40-year warranty covers the panel and its performance. And in the unlikely case you’ll ever need it, we make the return process simple and easy. With a historical return rate of only 1 in 20,000 panels under warranty*, you can rest assured your Maxeon solar panels are built to last.

Technical Product Documents

Maxeon: 40/40 Years

Performance 25/25 Years

Effective Date: April 1, 2025

Rev F

Utility-Scale, Power Plant

Performance 6: 12/30 Years

Performance 7: 15/30 Years

Effective Date: June 1, 2024

Product Datasheet

Ideal for Residential Applications

40-year Warranty

Product Datasheet

Ideal for Residential Applications

40-year Warranty

Product Datasheet

Ideal for Residential Applications

40-year Warranty

Product Datasheet

Ideal for Commercial Applications

40-year Warranty

Product Datasheet

Ideal for Residential Applications

40-year Warranty

Product Datasheet

Ideal for Residential & Commercial Applications

40-year Warranty

Product Datasheet

Ideal for Commercial Applications

40-year Warranty

The Maxeon Blog - Technology Deep Dives

At Maxeon, innovation isn’t a buzzword; it’s the foundation of everything we do. That’s why we’re pleased to announce a new patent licensing agreement with AIKO, an important milestone that validates both the strength of technology leadership and the value of intellectual property.

Among the numerous solar panel options available on the market today, Maxeon’s flagship interdigitated back contact (IBC) solar panels stand above the rest for their proven performance, reliability, and long-term financial returns.

The global trend toward clean, renewable energy is undeniable - with more individuals, businesses, and organizations realizing the cost savings as well as the ability to address climate change. Demand for solar power has seen a resulting surge.

As low-cost solar manufacturers continue to scale, and new, inexperienced market entrants proliferate—it’s important to understand the impact declining prices may have on the quality and reliability of their solar panels.

When it comes to solar, we’ve seen an increase in media reports profiling the impact of damaging hailstorms on solar installations around the world.

The good news is that Maxeon panels are uniquely engineered to stand up to the increasing severity of weather events brought on by climate change.

Maxeon Lights Up Barrancas del Cobre Adventure Park with Solar Energy, Promoting Environmentally Responsible Tourism.

SolarStratos: Setting New Limits as the First Manned Solar Plane to Reach the Stratosphere

The building and energy sectors have the most potential for significantly reducing greenhouse gas emissions and tackling climate change. More so, they have a responsibility to act given that, globally, CO2 emissions from the building sector are the highest ever recorded.

The EU's solar growth is surging, with rooftop panels poised to supply 25% of electricity, while Maxeon advances sustainability and decarbonization worldwide.

Solar panels are relatively low maintenance but as with any product problems can occur. So, to make you aware, we’ve put together this useful guide for you that shows you common problems with solar panels and how to avoid them.

The transition toward clean energy sources is pivotal in mitigating impacts of climate change, and major components of that transition include solar panels. Therefore, the demand for solar energy to power homes, businesses, and public spaces is growing.

Solar panels need to power through all weather conditions and maintain efficiency and reliability during their subsequent decades of operation, which is why panel testing must include parameters beyond temperature alone.

As more people seek alternative energy sources, the need for quality renewable energy continues to grow rapidly.

There’s an unfortunate reality many solar system owners only come to learn once they’ve installed solar: Shade happens. Read about how you can minimize the impacts of shading by choosing a better solar panel.

What is green building? Simply put, it's the environmentally-conscious construction (and operation) of buildings.

Solar energy works by capturing the sun’s energy and quietly and effectively turning it into electricity for your home or business.

See how Maxeon’s IBC solar cell technology vastly outperforms standard cells in stressful conditions.

A solar system is only as good as the quality of equipment you purchase. At the heart of every solar system are the panels, and at the heart of the panels are the cells. See how Maxeon’s IBC cell technology vastly outperforms standard cells in stressful conditions.